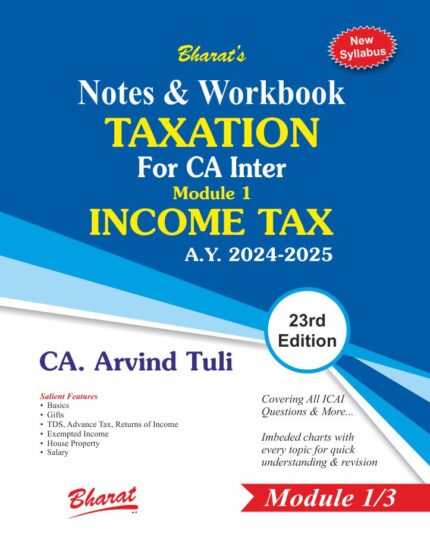

Taxation (Module 3) Goods & Services Tax CA Inter By CA. Arvind Tuli May 2024 Bharat Publication

“Master Goods & Services Tax (GST) for CA Inter with CA. Arvind Tuli. Explore in-depth taxation (M – 3) concepts and excel in your studies. Get expert guidance today!”

MODULE 3: G.S.T.

| Section | Chapter Name |

| A | Introduction to GST

A1: Power to make law A2: Overview of GST A3: Taxes subsumed after GST A4: No of Acts of GST in India A5: GST Council A6: Items not covered under GST A7: Import of service |

| B | Concept of Supply

B1: Overview of Sec 7 B2: Goods u/s 2(52) B3: Interest under GST B4: Import of Service u/s 7(1)(b) B5: Import of Service u/s 7(1)(b) & (c) B6: Distinct persons B7: Agents u/s 7(1)(c) B8: Negative List u/s 7(2) B9: Del Credere Agent |

| C | Exempted Supply

C1: Health Care service C2: Old age home C3: Rehabilitation professionals C4: Education services C5: Agricultural services C6: Due dates for ROI C7: Transportation of Goods & Passengers C8: The total summary for ROI C9: Legal Services |

| D | Registration under GST

D1: Liable to register D2: Compulsory registration u/s 24 D3: Exemption from registration u/s 23 D4: Due date for registration D5: Effective date for registration D6: Procedure for registration D7: Amendment of Registration D8: Cancellation of Registration D9: Revocation of cancellation D10: Cancellation & Revocation |

| E | Charge of GST

E1: Overview of Sec 9 E2: Transportation summary E3: GTA u/s 9(3) E4: Category II Summary E5: Govt./LA – Summary E6: Category III Summary E7: Category IV Summary E8: Sponsorship Service E9: Security Service E10: Banks Service E11: Builders u/s 9(4) E12: Eco u/s 9(5) |

| F | Composition Dealer

F1: Overview of Sec 10(1) / (2A) F2: Overview of Sec 10(1) F3: RCM u/s 10(1) F4: Registration for new dealer F5: Registration for normal dealer to CD F6: Turnover in a State F7: RD opting for CD |

| G | Time of Supply

G1: Overview of Sec 12 & 13 G2: Summary of Sec 12 G3: Sec 12(2) Forward Charge of goods G4: Sec 12(3) Reverse Charge of goods G5: Summary of Sec 13 G6: Sec 13(2) Forward Charge of Service G7: Sec 13(2) Reverse Charge of Service. |

| H | Value of Supply |

| I | Payment – Ledger System |

| J | Input Tax Credit

J1: Overview of Sec 16 J2: Blocked Credit – 1 J3: Blocked Credit – 2 J4: Blocked Credit – 3 J5: Blocked Credit – 4 |

| K | Documents under GST

K1: Summary |

| L | E-Way Bill

L1: Summary L2: Timelines E-Invoice L3: Summary |

| M | Returns |

| N | Accounts & Records |

| O | TDS & TCS |

| P | Place of Supply |

Reviews

There are no reviews yet.